Rumored Buzz on Bankruptcy Attorney Tulsa

Rumored Buzz on Bankruptcy Attorney Tulsa

Blog Article

Not known Incorrect Statements About Bankruptcy Attorney Tulsa

Table of ContentsThe 8-Minute Rule for Bankruptcy Attorney Near Me TulsaExcitement About Tulsa Ok Bankruptcy AttorneyNot known Details About Tulsa Bankruptcy Filing Assistance The Ultimate Guide To Chapter 7 Bankruptcy Attorney TulsaUnknown Facts About Experienced Bankruptcy Lawyer Tulsa

The statistics for the various other main kind, Chapter 13, are even worse for pro se filers. (We break down the differences between both key ins deepness listed below.) Suffice it to say, talk with a legal representative or more near you that's experienced with insolvency law. Below are a couple of resources to locate them: It's easy to understand that you may be hesitant to pay for a lawyer when you're currently under significant economic stress.Many lawyers likewise supply free examinations or email Q&A s. Take benefit of that. Ask them if bankruptcy is undoubtedly the best selection for your situation and whether they believe you'll certify.

Advertisements by Cash. We might be made up if you click this ad. Advertisement Since you have actually decided personal bankruptcy is without a doubt the best program of activity and you hopefully cleared it with a lawyer you'll require to get begun on the documentation. Prior to you dive into all the official bankruptcy types, you ought to get your own documents in order.

The 10-Second Trick For Chapter 13 Bankruptcy Lawyer Tulsa

Later on down the line, you'll really require to confirm that by disclosing all kinds of details regarding your monetary events. Here's a fundamental list of what you'll require when driving ahead: Identifying documents like your motorist's permit and Social Safety and security card Income tax return (up to the past four years) Evidence of revenue (pay stubs, W-2s, freelance profits, earnings from properties as well as any type of income from federal government benefits) Financial institution declarations and/or pension declarations Proof of worth of your assets, such as lorry and realty evaluation.

You'll desire to comprehend what kind of financial debt you're attempting to fix.

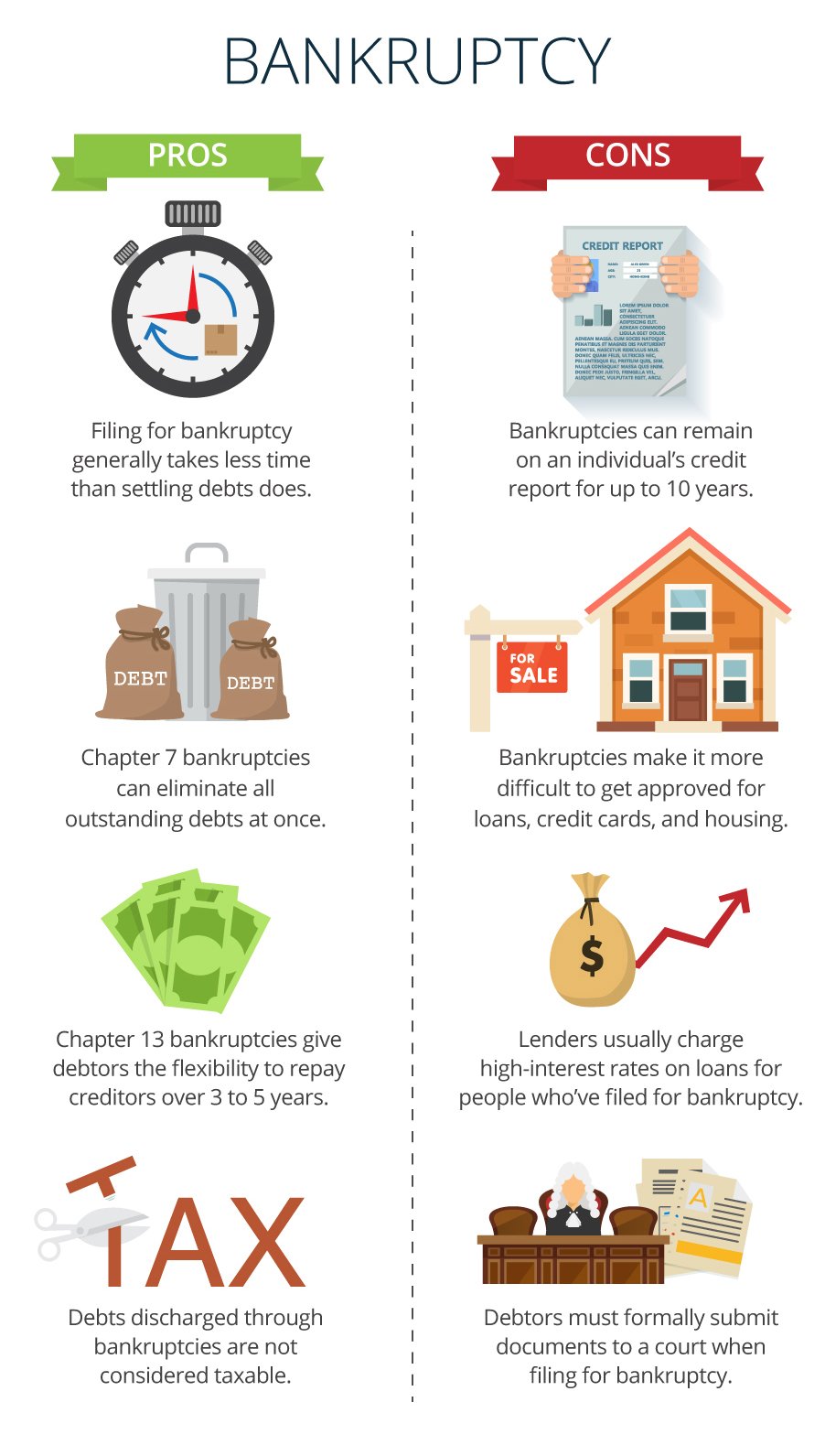

You'll desire to comprehend what kind of financial debt you're attempting to fix.If your earnings is as well high, you have another alternative: Phase 13. This option takes longer to solve your financial obligations due to the fact that it needs a long-term settlement strategy generally 3 to five years before some of your continuing to be financial debts are wiped away. The filing procedure is also a lot extra intricate than Phase 7.

Chapter 7 - Bankruptcy Basics Fundamentals Explained

A Phase 7 personal bankruptcy remains on your credit history report for 10 years, whereas a Phase 13 insolvency falls off after seven. Before you submit your insolvency kinds, you need to initially finish a required program from a debt counseling agency that has actually been approved by the Division of Justice (with the significant exception of filers in Alabama or North Carolina).

The training course can be completed online, bankruptcy lawyer Tulsa personally or over the phone. Training courses generally set you back between $15 and $50. You need to finish the program within 180 days of declare insolvency (Tulsa bankruptcy attorney). Use the Department of Justice's site to find a program. If you reside in Alabama or North Carolina, you need to select and complete a course from a listing of separately authorized service providers in your state.

6 Easy Facts About Tulsa Ok Bankruptcy Specialist Shown

A lawyer will commonly manage this for you. If you're filing on your own, know that there are about 90 different bankruptcy areas. Check that you're submitting with the appropriate one based upon where you live. If your irreversible house has relocated within 180 days of loading, you ought to submit in the area where you lived the greater part of that 180-day duration.

Normally, your personal bankruptcy lawyer will deal with the trustee, yet you might require to send the person documents such as pay stubs, income tax return, and checking account and charge card statements directly. The trustee that was just designated to your case will certainly soon establish a necessary conference with you, referred to as the "341 meeting" since it's a requirement of Area 341 of the united state

You will need to give a prompt listing of what certifies as an exemption. Exemptions may put Tulsa bankruptcy lawyer on non-luxury, key automobiles; necessary home goods; and home equity (though these exceptions rules can differ commonly by state). Any building outside the checklist of exemptions is considered nonexempt, and if you don't provide any kind of checklist, after that all your property is thought about nonexempt, i.e.

You will need to give a prompt listing of what certifies as an exemption. Exemptions may put Tulsa bankruptcy lawyer on non-luxury, key automobiles; necessary home goods; and home equity (though these exceptions rules can differ commonly by state). Any building outside the checklist of exemptions is considered nonexempt, and if you don't provide any kind of checklist, after that all your property is thought about nonexempt, i.e.The trustee would not market your cars to promptly pay off the creditor. Instead, you would pay your lenders that amount over the course of your repayment strategy. A typical mistaken belief with bankruptcy is that as soon as you submit, you can quit paying your debts. While personal bankruptcy can assist you eliminate many of your unprotected financial debts, such as past due medical bills or individual loans, you'll intend to keep paying your month-to-month settlements for safe debts if you wish to maintain the property.

Rumored Buzz on Tulsa Ok Bankruptcy Attorney

If you go to danger of repossession and have actually tired all various other financial-relief choices, then applying for Chapter 13 might delay the foreclosure and assistance save your home. Inevitably, you will certainly still require the revenue to continue making future mortgage settlements, along with settling any late repayments over the training course of your layaway plan.

If so, you may be needed to give added details. The audit could delay any type of financial obligation alleviation by a number of weeks. Obviously, if the audit shows up incorrect information, your case can be disregarded. All that stated, these are fairly uncommon instances. That you made it this much in the process is a suitable sign at least several of your financial obligations are qualified for discharge.

Report this page